Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

– The situation of the banking system

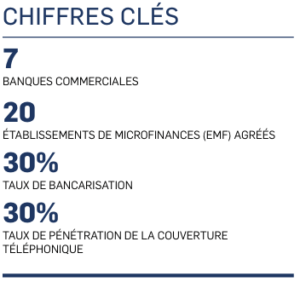

With a high rate of bank penetration, the banking sector is in good health. Affected by the COVID-19 pandemic, the sector quickly showed signs of resilience, particularly in terms of liquidity, and the Central Bank played a decisive role in supporting the economy.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

Well integrated into the regional market, the Gabonese banking sector, the second largest in the CEMAC in terms of assets, is characterized by its high concentration around a few players: BGFI, BICIG, Orabank, Ecobank, Citibank Gabon, United Bank for Africa Gabon (UBA Gabon) and the Union Gabonaise de Banque (UGB). Financial institutions are also present: Finatra (a subsidiary of BGFI), Alios Finance, Bicig-Bail (a subsidiary of BICIG). The headquarters of the Central African Banking Commission (COBAC) is located in Libreville.

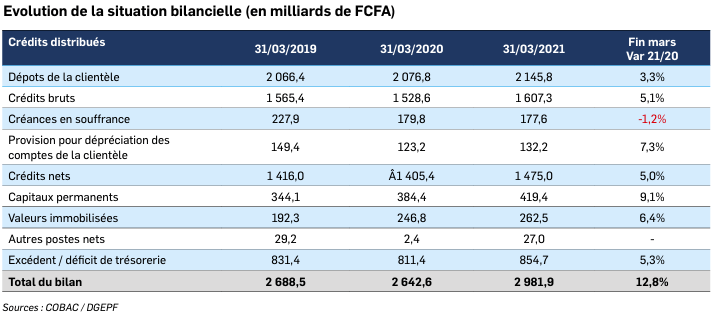

According to the International Monetary Fund (IMF), all Gabonese banks were declared solvent and liquid at the end of 2020, with the solvency ratio close to 18% (minimum: 9.5%) and the short-term liquidity ratio above 160% (minimum: 100%). The recovery in banking activity, which began in the fourth quarter of 2020, continued until the end of the first quarter of 2021.

In the third quarter of 2021, total bank balance sheets increased by 14.6% to 3,045.1 billion FCFA compared to 2,656.4 billion a year earlier.

According to Cobac, this development is essentially linked to the increase in customer deposits (+4.9% to 2,182.3 billion FCFA) and the consolidation of permanent capital (+25.2%).

However, the deposit coverage rate deteriorated, but remains at a high level, falling from 157.8% as of September 30, 2020 to 137.3% during the period under review. As for non-performing loans, they fell by 7.9% to stand at 168 billion FCFA at the end of September 2021, reflecting the gradual return of economic activity.

According to statistics, resources collected by the sector increased by 4.9% to 2,182.3 billion FCFA in the third quarter of 2021. Thus, demand resources consolidated by 6% to 1,500.7 billion FCFA, mainly driven by the increase in private deposits (+4%) and non-resident deposits.

These deposits represent the main resources of the banking system, representing 68.8% of total deposits compared to 68% during the same period the previous year.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference

Term deposits collected from customers, mainly consisting of term deposits and special deposit accounts (cash certificates), increased by 2.8% to 573.1 billion compared to 557.4 billion FCFA a year earlier. In September 2021, these resources represented 26.3% of the total deposits collected.

Over the period under review, public deposits increased from 7.9% to 97 billion FCFA, representing 4.4% of the total deposits collected against 5.1% at the end of the same period in 2020.

Deposits of public enterprises followed the same downward trend (-18.9%) to 63.7 billion FCFA. On the other hand, deposits of the non-financial private sector increased by 4% to 1,806.1 billion FCFA.

Unlike public deposits, gross credits distributed rose by 18.9% to 1,715.5 billion FCFA against 1,442.7 billion a year earlier, driven mainly by credits granted to the private sector during the period.

Indeed, credits granted to the private sector increased by 19.3% to 1,172.2 billion FCFA at the end of the third quarter of 2021, or 68.3% of all gross credits distributed.

Year-on-year, credits granted to the State increased by 9.6% to 422.3 billion FCFA in September 2021. They represented 24.6% of total credits compared to 26.7% in September 2020.

Credits granted to public enterprises, which represented 0.5% of total gross credits, fell by 4.8% to 8 billion FCFA at the end of September 2021 compared to 8.4 billion a year earlier.

Finally, there was a slight improvement in leasing operations, the outstanding amount of which amounted to 16 billion FCFA in September 2021 compared to 15.9 billion a year earlier.

The Central African Banking Commission (COBAC), the banking sector watchdog, has banned banks from distributing dividends in order to have the resources needed to participate in the revival of the regional economy.

Capacity building of the judiciary has progressed well with the new commercial court dealing with credit disputes now operational in Libreville, with 15 judges and 8 bailiffs.

Space not available

Reserve this advertising space

Selected ad format

The file format is not recognized

Click here for

upload an ad

Click here to download

an announcement

Here drag and drop or

upload an ad

Send the ad up to 8 days after payment

A link will be sent to you by contact@via-agency.media

Reserved space

Announcement transmitted

Reference